7 Ingredients to find the best Payment Gateway

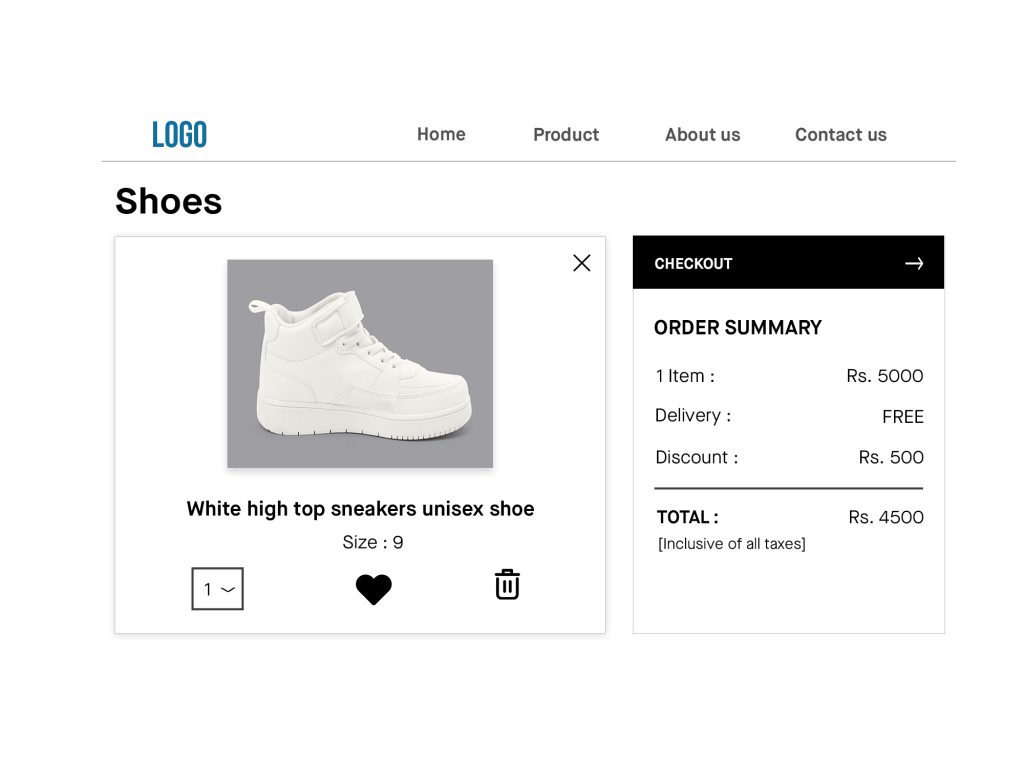

The payment gateway is one of the most vital aspects of eCommerce business, yet it is neglected by many business owners. They are so engrossed with marketing, product development, advertising, logistics, and administration that they do not realize that a Payment gateway is like an endgame. It is the point where the customer hands over the money for which an eCommerce business has strived so hard. One wrong impression and all the efforts go down the drain.

A first-time buyer is always apprehensive about buying products in a brand-new online store. This fear reaches its peak at the time of payment. Your job as an eCommerce business owner is to make their experience stress free. Therefore, selecting the Right Payment Gateway for eCommerce store is a “make or break” decision. Having an easy payment system that is run through a trustworthy vendor can help you transform buyers feeling when they shop on your website.

As payments are the most important part of your business, finding the right payment gateway is imperative. A secure, efficient, and fast payment gateway not only improves customer experience and trust but also gives you peace of mind. Do consider the following factors while choosing a payment gateway for your online store:

⦁ Multiple Payment options

⦁ 24/7 Customer Support

⦁ Security features

⦁ Pricing

⦁ Integration method

⦁ Transactional Efficiency

⦁ Country Coverage

Let us discuss them…

1. Multiple Payment options:

The recent Fintech boom offers many lucrative payment options. To move ahead of the competition, Fintech companies offer users cashback, redemption points, and discounts on purchases made through their payment service. No one, especially online shoppers will miss an opportunity to save money. To satisfy customers, an eCommerce owner must provide all possible payment options needed by their target market.

According to statics by SaleCycle 6 % of cart abandonment happens because of a Lack of Payment options. This can be prevented by opting in for a reliable payment gateway service that provides you the maximum number of payment options on a single window and that too without restriction.

2. 24/7 Customer Support:

A 24/7 customer is a must these days. Suppose you are a business with payment gateways set up to receive thousands of dollars every day. A downtime of one hour can cause a lot of damage and dent your reputation.

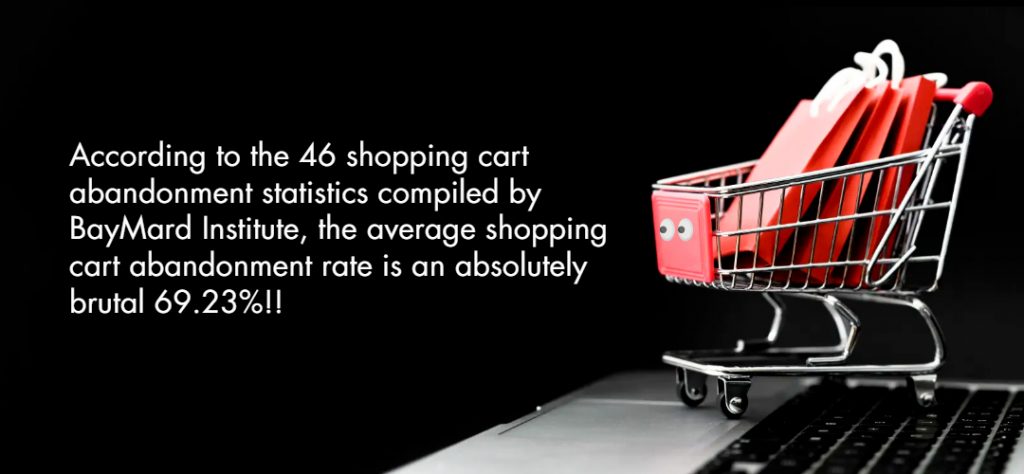

According to Baymard Institute, 20% of cart abandonment during checkout happen because of website errors or crash. A 24/7 payment gateway support allows you to be highly receptive to the needs of your customers and get quick assistance during an emergency. It not only helps you minimize cart abandonment due to glitches but also helps you improve customer experience, customer retention, and brand loyalty.

In short, it is critical to review the type of customer support offered by a payment gateway before you sign up for it. Always choose the payment gateway that not only fits your budget but also makes for a great partner for the future.

Until and unless you or your staff is technically sound, don’t fall for free or cheap payment gateways that encourage DIY support.

3. Security features:

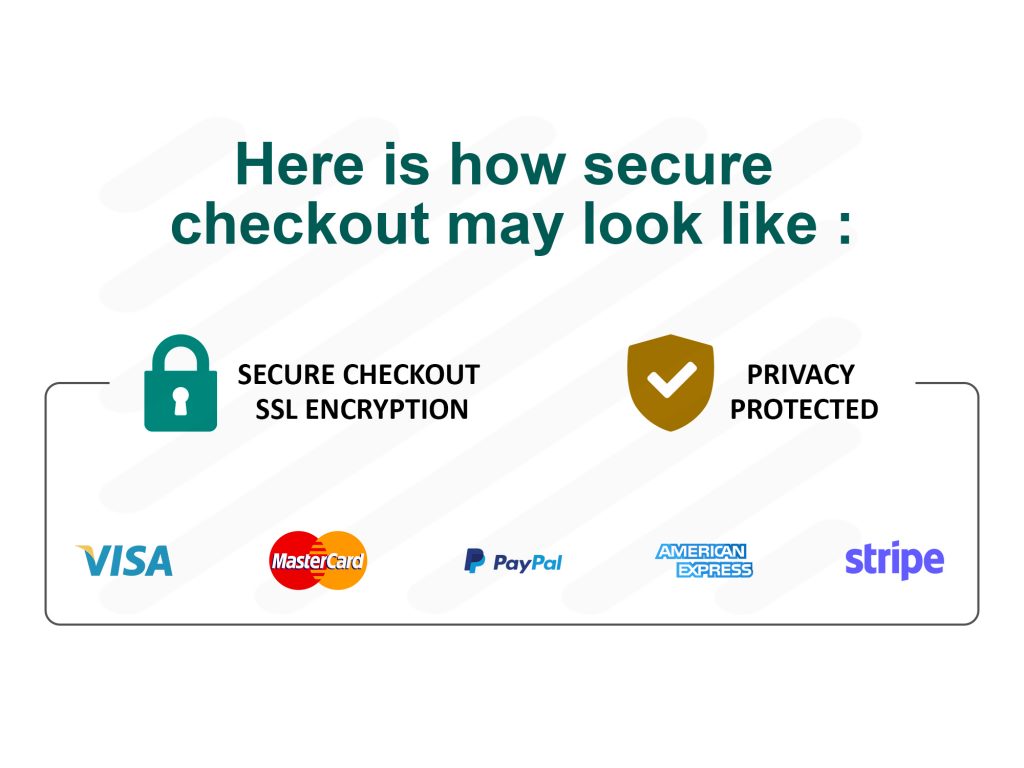

Research shows that in the year 2021, online companies lost $20 billion to e-commerce fraud, and it is predicted to rise. Make sure you secure your website against fraud. The security of transaction data on your website should be the uppermost priority for you, as it can seriously dent your market image.

When choosing a payment gateway, you must review the security and fraud protection services offered by them. A few important security features that a reliable payment gateway provides are:

⦁ PCI DSS Compliance

⦁ Data encryption

⦁ Secure socket layer ( SSL )

⦁ Secure electronic transaction ( SET )

⦁ Payment Tokenization

⦁ 3d secure 2.0

⦁ Fraud Monitoring and Protection

⦁ Employee training

The safety of the financial information on your website is your responsibility. It is always wise to pay a little more and choose or set up a secure, robust, and reliable payment gateway. Remember, there is no coming back from a data breach.

4. Pricing:

Pricing is one of the most important factors during a payment gateway selection. Before choosing a payment gateway always do your homework.

Analyze your business model, the cost of the product you sell, the types of payments you accept, the target audience, the amount of money you receive on a monthly/annual level, and so on. For example: if you sell low-cost products, high fees may adversely impact your profit.

Some examples of the fee charged by payment gateways are listed below.

⦁ Set-up fee.

⦁ Monthly fee or Annual fee.

⦁ Interchange fee.

⦁ Assessment fee.

⦁ Mark-up fee.

⦁ Processing fee.

Try to Keep costs as low as possible, but do not fall for payment gateway integration services that compromise your security, have functionality problems, have high downtime, and so on. It is better to pay a little more than to lose your reputation in the market.

5. Integration method:

The selection of payment gateway integration must complement your business needs. As your business grows, the payment gateway you select must be able to scale up effortlessly to meet the ever-changing needs of your customers.

There are three main methods to integrate a payment gateway:

⦁ Hosted gateway

⦁ Direct Post Method

⦁ Non-hosted gateway

Let’s discuss them.

6. Hosted payment gateway integration:

It is a third-party checkout system in which the customer will leave your website to complete payment on the service provider’s (PSP) page and then returns to the website to finish the checkout process. The hosted payment gateway offers easy integration, and one does not have to worry about security, but it comes with provider fees and a lack of control that might impact conversion rates.

7. Direct Post Method payment gateway integration:

It gives complete control over the checkout pages. You can easily and minutely brand, and customize your checkout page as your need, add analytics, and so on. In this method, you do not need Payment Card Industry Data Security Standard (PCI-DSS) compliance and can host it on your server. The flip side of this method is that it is not completely secure and might compromise your customer data with cybercriminals and hackers.

8. Non-hosted payment gateway integration:

It is for those businesses who want to make their payment system as per their needs. This is for the likes of Amazon, who can create and maintain the infrastructure of the payment gateway as per Payment Card Industry Data Security Standard (PCI-DSS) compliance or similar and afford it in the long run.

All three payment gateway integration methods have their pros and cons. You can choose the one that best suits your business in terms of budget, requirements, and long-term goals.

9. Transactional Efficiency:

It is about how smooth is the payment experience for your customers. The 3 main things that impact Transactional Efficiency on a payment gateway are:

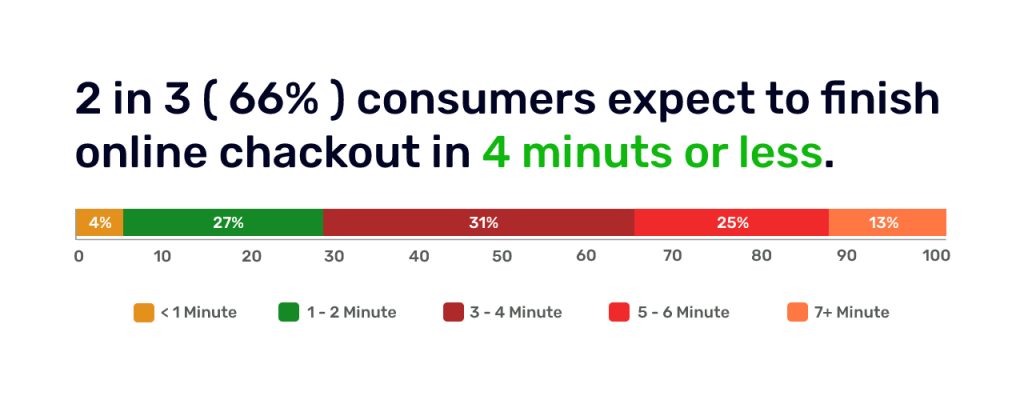

10. Slow checkout process on the gateway:

29% of online shoppers expect to complete online checkout in under two minutes. If your gateway is loading slowly, you need to get it correct or find a better one.

11. Account creation request by Payment Gateway:

This a big “NO”. As per Statista, 22% of cart abandonment happens because of account creation requests. You should make sure your payment gateway should never ask your customer for account creation. Its job is to only collect payment for you.

12. Glitches, Downtime, and Crashes:

As per Baymard Institute research, 20 % of cart abandonment during check happen because customer encounter glitches, downtime, and crashes. If your payment gateway is a habitual offender on these things, you need to part ways immediately. Our recommendation is always to sign up for a payment gateway that offers 24/7 support.

Make sure that you or your staff keeps a check on all 3 parameters on a random basis to ensure Transactional Efficiency is not impacted.

13. Country Coverage:

For ecommerce businesses that target customers across the globe, they must check the country coverage of the payment gateway before subscribing. Some payment gateway providers only accept local payment methods or support local banks, this can limit your customer base and impact your sales.

If your long-term target is to go global, it is always wise to opt-in for a payment gateway with broad coverage, even if your business is in the initial stage and only shipping goods locally. This will allow you to quickly scale when needed and would not limit you on encashing random sale opportunities from a different country.

Conclusion:

Always remember, you are not married to a Payment Gateway and that there are other reliable payment gateway integration services in the market. Do your homework before choosing a payment gateway. Always keep your customer and business first.

After setting up the payment gateway, make sure that you randomly check the payment gateway workflow to ensure that it is properly serving your customer and giving value to your business.

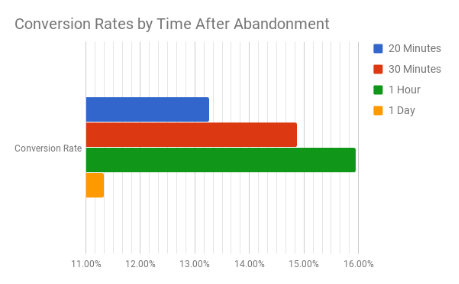

Keep a check on the conversion rate as it works as a dipstick to measure the performance of a gateway. If it is improving or is as per your satisfaction, the gateway is doing a good job, else it’s time to switch. Happy Selling!!